Get Bridging Loans in Kent Fast

Lending Experts for Kent

Whether a deal lands or gets lost; most of the time, having the money at the right time is what truly makes the difference. In a situation where you want to eventually move to a long-term finance – you can sell your property or you can refinance your mortgage – a bridging loan will be the one to provide you the money you need before then. These are exactly the loans that we have in our arsenal.

Since it has good transport connections to London specifically by train, Kent remain altogether a good place to live with many beachside, countryside and town centre areas to invest in. The average home sells here for about £384 000.

What we do

- We are able to finance you with a minimum of £10,000 and a maximum of £500,000

- We inform you of our decision within 4 hours

- Funds get to you within 48 hours

- The application is simple and brief

- We can finance your home purchase

- We can finance your business premises purchase

- We offer a line of credit for business needs

- Financing for property bought at auction

Get a bridging loan in Kent

The process is a matter of minutes. Over the phone contact with you, we convey the information regarding the amount and the cost of the credit for which you qualify. In case you confirm your interest, we arrange the valuation and the legal work and we proceed with the file completion.

You collaborate with one advisor only from the beginning till the end. Besides, you will have that person’s direct number and receive frequent straightforward updates. Whether you refinance, buy, refurbish or you are simply in need of a timing gap to be covered, we provide the short term capital that is a perfect fit for your bigger property plan.

Homeowners

Place your home as a security to unlock vital funds that can help to stop chain delays or to carry out refurbishments on your building when cash is tight.

Developers

Borrow money over carefully planned out stages to bring your project to life. Great for commercial developments where management is key.

Commercial Investors

Secure the money needs to invest in new business locations, or to relocate current operations. Great for building or expanding investment portfolios.

Business owners

Navigate the day to day challenges of business more efficiently with fast capital injections. Good for stock replenishing or covering expenses.

In Kent, the most common bridging loan size is £250,000

Use our calculator below for an instant estimate of borrowing capacity and likely repayments.

Bridging Loan Calculator

Bridging: Indicative Quote

Total Security Value: £400,000.00

Gross Loan: £103,008.00

Gross LTV: 25.75%

Interest Rate: 0.84%

Breakdown

Arrangement Fee (2%): £2,000.00

Broker Fee (1%): £1,000.00

Total Interest: £10,080.00

Net Loan: £100,000.00

Legal Fees: £750.00

Valuation Fees: £380.00

Most Common Uses of Bridging Finance in Kent

- Property purchase prior to sale of an existing one (chain break)

- Acquisition of properties sold by auction (usually 28-day completion)

- Refurbishment or conversion projects (light or heavy)

- Investment / buy-to-let purchases

- Commercial or mixed-use property transactions

- Land acquisition or change-of-use funding

- Business cash–flow or interim funding solutions

- Exit from development (sale or refinance)

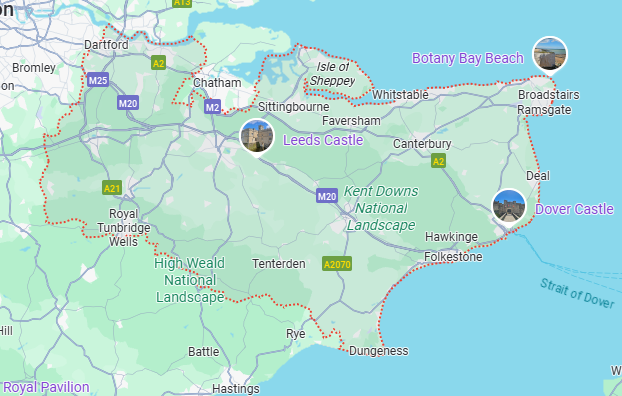

Areas we serve in Kent

- Canterbury

- Folkestone & Hythe

- Sevenoaks

- Whitstable

- Sittingbourne

- Maidstone

- Dover

- Tonbridge

- Faversham

- Medway

- Tunbridge Wells

- Gravesend

- Ramsgate

- Deal

- Herne Bay

- Ashford

- Dartford

- Margate

- Hythe

- Thanet

“We needed a £160,000 short-term facility to take a Kent townhouse conversion off the market; the team acted quickly and we were able to get in front of another bidder.”

Marlene Jackson – Property Investor, Tonbridge

“In the case of a £205,000 commercial-to-residential redevelopment in Canterbury, we opted for bridging finance: the entire process was done swiftly, and, without delay the funding came.”

George Halliday – Developer, Canterbury

“Our auction purchase needed a loan to finish it off and it was just the right amount of £84,750 – that was done with minimal time and little fuss.”

Justine Grayson – Landlord, Dover