Urgent Property Finance in Essex

Lending Experts for Essex

In Essex, where the market is changing rapidly and you can see a lot of redevelopments, conversions and auction purchases, a bridging loan is what gives you the freedom to be able to act when others are stood still waiting. Our lending arrangement are specifically designed to provide you with quick assistance while you secure a longer-term loan, wait for a sale or complete the refinancing process.

We are very committed to the factor of speed and also to the setting up of finances that go hand in hand with your intended way out (exit route).

What we offer

- Loan amounts starting at £10,000 to £500,000

- Decisions on most applications take as little as 4 hours

- Money can be put in your bank in as fast as 48 hours

- Straightforward application, no hassles

- Lending on residential property

- Property loans for commercial buildings

- Short-term business finance

- Auction home purchase loans

Put in an application for a bridging loan in Essex

Our application process is transparent, efficient and structured in such a way that it ticks the key box – expediency. From your initial contact with us, we outline the possible avenues, verify your eligibility and present tentative terms with very little waiting time. After the agreement, we take care of all the third-party works (valuations, legal due diligence, etc.) that are necessary for a hassle-free transaction from processing to signing.

You will always be in touch with your personal adviser who will inform you of each important step without unnecessary involvement. Our mission is very simple: to give you access to short-term funds which cater for your long-term property plans whether you are buying, refinancing, refurbishing, or solving a timing problem.

Homeowners

Place your home as a security to unlock vital funds that can help to stop chain delays or to carry out refurbishments on your building when cash is tight.

Developers

Borrow money over carefully planned out stages to bring your project to life. Great for commercial developments where management is key.

Commercial Investors

Secure the money needs to invest in new business locations, or to relocate current operations. Great for building or expanding investment portfolios.

Business owners

Navigate the day to day challenges of business more efficiently with fast capital injections. Good for stock replenishing or covering expenses.

£250,000 is the most common bridging loan in Essex

Use our calculator below to get an approximate idea of how much you could borrow and what your repayments might look like.

Bridging Loan Calculator

Bridging: Indicative Quote

Total Security Value: £400,000.00

Gross Loan: £103,008.00

Gross LTV: 25.75%

Interest Rate: 0.84%

Breakdown

Arrangement Fee (2%): £2,000.00

Broker Fee (1%): £1,000.00

Total Interest: £10,080.00

Net Loan: £100,000.00

Legal Fees: £750.00

Valuation Fees: £380.00

Typical applications of bridging finance in Essex

- Buying before selling your own home (breaking the chain)

- Property bought at auctions (often with 28-day completions)

- Home improvements or change of use work (light or heavy)

- Real estate investment and buy-to-let purchases

- Commercial or mixed-use property transactions

- Land purchase or change-of-use funding

- Business cash-flow or interim funding solutions

- Exit from development (sale or refinance)

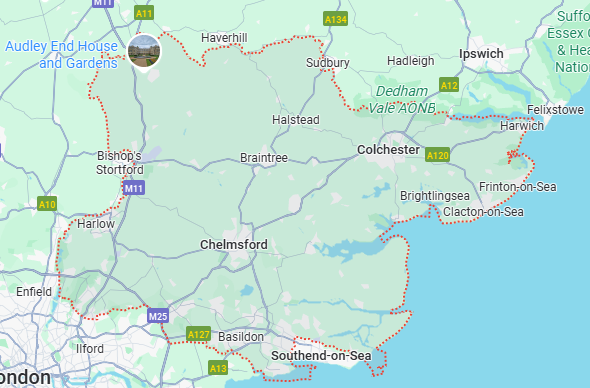

Essex areas that we serve

- Chelmsford

- Brentwood

- Canvey Island

- Waltham Abbey

- Epping

- Colchester

- Harlow

- Billericay

- Frinton and Walton

- Great Dunmow

- Basildon

- Maldon

- Rayleigh

- Harwich

- Brightlingsea

- Braintree

- Clacton-on-Sea

- Witham

- Saffron Walden

- Burnham-on-Crouch

“We arranged a short-term facility worth £190,000 to complete the purchase of a townhouse conversion in Chelmsford; before the team was able to turn things around, another investor was ready to step in.”

J. Morgan – Property Investor, Chelmsford

“We decided to use bridging finance for a £240,000 commercial-to-residential project in Colchester: the funds were made available quickly, and we were kept well informed throughout the process.”

K. Singh – Developer, Colchester

“Just the service I expected – a team that is always there when you need them and the funds that were exactly delivered when I anticipated.”

R. Pritchard – First Time Buyer, Harlow