Urgent Southampton Property Loan

Short-term funding across Southampton backed on residential or commercial properties.

Lending Experts for Southampton

Southampton’s real estate is very dynamic and the areas that are mostly affected by that are the waterfront, the regeneration areas and the student districts that have grown around the two universities. Those who want to rent will be competing vigorously for well-located rentals, new city centre apartments and port-related commercial units.

In case the right opportunity comes up, a bridging loan enables you to make a move right away rather than waiting for a long lender process. We know that Southampton is moving very fast and we arrange your funds to be able to continue without waiting.

What we offer

- Loan amounts starting at £10,000 to £500,000

- Decisions on most applications take as little as 4 hours

- Money can be put in your bank in as fast as 48 hours

- Straightforward application, no hassles

- Lending on residential property

- Property loans for commercial buildings

- Short-term business finance

- Real estate auction financing

Apply in Southampton for bridging loans

When you get in touch with us we take over the entire management to free up your time. We set up inspections, talk to lawyers and do all the work needed by the lenders while you concentrate on other things. You are always kept in the loop and you know exactly which step comes next.

Southampton is a city that gives back to those who are quick to act. Be it that you are purchasing before selling, starting a refurbishment project, or finishing an auction purchase, we are there to make sure that the funding side is easy and foreseeable. We work to eliminate all kinds of delays and ensure things are always in sync so that money can be handed over at the earliest possible time.

Homeowners

Place your home as a security to unlock vital funds that can help to stop chain delays or to carry out refurbishments on your building when cash is tight.

Developers

Borrow money over carefully planned out stages to bring your project to life. Great for commercial developments where management is key.

Commercial Investors

Secure the money needs to invest in new business locations, or to relocate current operations. Great for building or expanding investment portfolios.

Business owners

Navigate the day to day challenges of business more efficiently with fast capital injections. Good for stock replenishing or covering expenses.

£250,000 is the most common bridging loan in Southampton

Use our calculator below to get an approximate idea of how much you could borrow and what your repayments might look like.

Bridging Loan Calculator

Bridging: Indicative Quote

Total Security Value: £400,000.00

Gross Loan: £103,008.00

Gross LTV: 25.75%

Interest Rate: 0.84%

Breakdown

Arrangement Fee (2%): £2,000.00

Broker Fee (1%): £1,000.00

Total Interest: £10,080.00

Net Loan: £100,000.00

Legal Fees: £750.00

Valuation Fees: £380.00

Common uses for bridging loans in Southampton

- Buying rental properties close to the universities and student districts

- Buying apartments in Ocean Village area and other waterfront locations

- Refinancing after refurbishing with a loan

- Bridging the gap between selling one property and buying another

- Acquisition of commercial or mixed-use units linked to port and logistics sector

- Going through the process of auction purchases with strict deadlines

- Helping business relocation or expansion in the greater Southampton area

- Transforming old homes into sought-after student accommodation

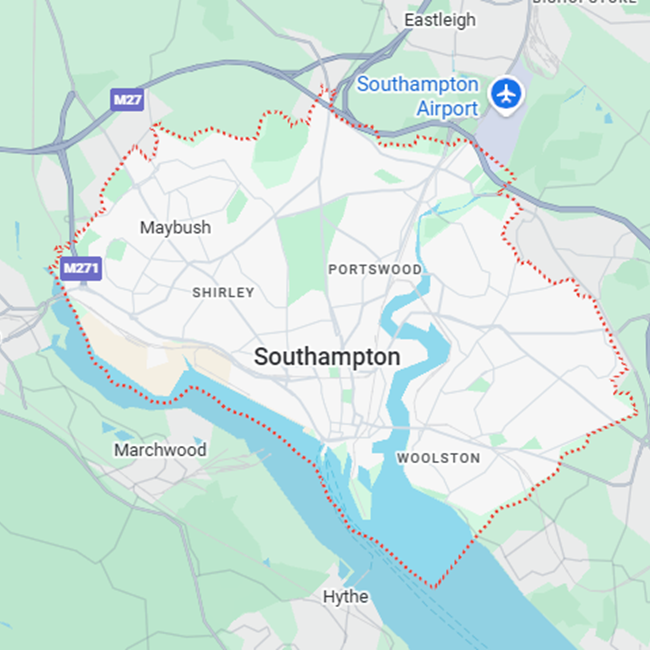

Southampton areas that we serve

- Ocean Village

- Portswood

- Shirley

- Bitterne

- Highfield

- Millbrook

- Freemantle

- Woolston

- Weston

- Bassett

- Swaythling

- Redbridge

- Northam

- Bitterne Park

- Bevois Valley

- St Denys

- Lordswood

- Southampton Centre

- Thornhill

- Midanbury

“I was in need of £190,000 to be able to purchase an apartment in Ocean Village prior to my next purchase. The whole experience was transparent and everything was done in a timely manner.”

Helen Morris, Homebuyer, Ocean Village

“I raised £102,000 to move my workshop close to Redbridge. Throughout the entire process, Goldhill Finance was in charge of everything which enabled me to concentrate on the move.”

Anthony Collins – Business Owner, Redbridge

“I was in need of £340,000 for a refurbishment project in Portswood. The team was in sync with the timeline and they released the funds without any delays.”

Rachel Turner – Property Developer, Portswood