Bridging Loan Completion in Sheffield

Access private lender solutions for quick finance deals across Sheffield.

Lending Experts for Sheffield

If need to get on with a property transaction quickly, a bridging loan in Sheffield provides you with the pace and adaptability to proceed the deal you want before it is not available anymore. Sheffield property market is very dynamic and different areas can have very different tempo in terms of transactions.

We understand that Sheffield is a very varied market – from city-centre studios to large industrial units and family homes across South Yorkshire. Since we grant funds out of our own reserves, it is us who take the decisions and because of that, the time between decision and execution is very short – usually within hours and not days – helping you to move without any waiting time.

What you get from us

- Loan options of £10,000 and as high as £500,000

- Immediate decisions, hear back from us in 4 hours

- Money wired to your bank as quickly as 48 hours

- Easy application and simple communication

- Loans against residential property

- Loans for commercial or investment purchases

- Short-term business finance arrangements

- Specialist loans for buying property at auction

Bridging loan application in Sheffield

Getting a bridging loan ought not to be complicated. Taking the initiative, we handle the whole process from the initial call and we work with solicitors, valuers, and lenders to get the job done for you. You will not have to get on with the work and trouble of updating the people involved or doing the unnecessary paperwork, which we keep at a minimum, working efficiently and transparently.

Speed is the key factor in Sheffield property markets. Be it preemptive purchase before selling, buying up the property in a hot area, or bridging the refurbishing project, our aim is to delay no more and have the funds ready quickly. Our deep knowledge of the local trends and the ability of making decisions rapidly give you the opportunity to outmatch others and move on with confidence.

Homeowners

Place your home as a security to unlock vital funds that can help to stop chain delays or to carry out refurbishments on your building when cash is tight.

Developers

Borrow money over carefully planned out stages to bring your project to life. Great for commercial developments where management is key.

Commercial Investors

Secure the money needs to invest in new business locations, or to relocate current operations. Great for building or expanding investment portfolios.

Business owners

Navigate the day to day challenges of business more efficiently with fast capital injections. Good for stock replenishing or covering expenses.

The most popular bridging loan in Sheffield is £95,000

Use the calculator below to assess your borrowing capacity and repayment costs.

Bridging Loan Calculator

Bridging: Indicative Quote

Total Security Value: £400,000.00

Gross Loan: £103,008.00

Gross LTV: 25.75%

Interest Rate: 0.84%

Breakdown

Arrangement Fee (2%): £2,000.00

Broker Fee (1%): £1,000.00

Total Interest: £10,080.00

Net Loan: £100,000.00

Legal Fees: £750.00

Valuation Fees: £380.00

Sheffield bridging loan use examples

- Purchasing student rental properties near major universities

- Quickly completing purchases in highly competitive areas

- Refurbishing or converting older terraces to modern rental units

- Helping sustaining business cash flow during periods of growth or relocation

- Buying commercial units or light industrial properties

- Bridging short gaps between property sales and purchases

- Funding auction purchases with quick completions

- Offering an exit strategy from development or refurbishment funding

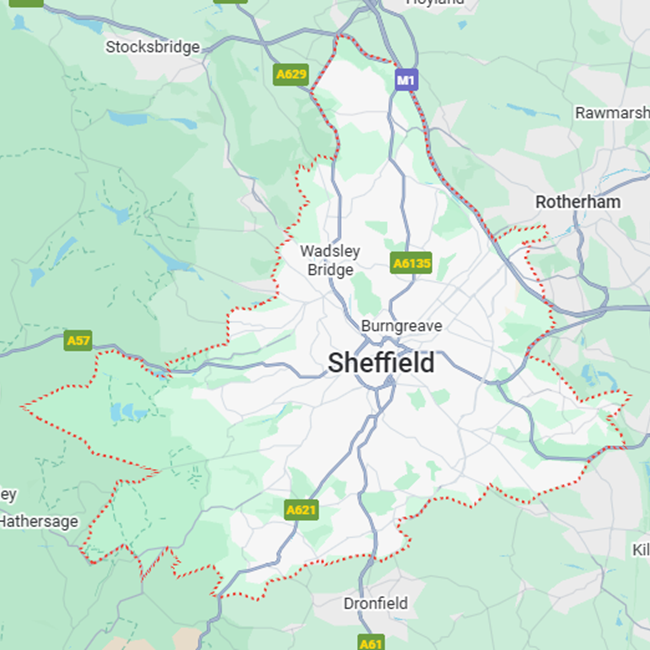

Sheffield areas we serve

- Hillsborough

- Ecclesall

- Walkley

- Crookes

- Broomhill

- Kelham Island

- Dore

- Totley

- Nether Edge

- Fulwood

- Stannington

- Heeley

- Sharrow

- Woodseats

- Norton

- Attercliffe

- Meadowhall

- Handsworth

- Sheffield City Centre

- Chapeltown

“It was necessary to get a loan of £190,000 to be able to buy a house in Fulwood for my family before my sale was completed. Everything was managed by Goldhill Finance fast and they kept the process simple. Without them, I could not have moved.”

Helen Carter – Homeowner, Fulwood

“It was possible to raise £85,000 to be able to support the short-term cash flow I needed while relocating my workshop in Attercliffe. Quick decisions and open communication – that’s what a business owner needs.”

Martin Hughes – Business Owner, Attercliffe

“I was in need of a £430,000 bridging loan for a small development project in Sharrow. The team was very efficient, they got the project, and they did not wait to hand over the money.”

Daniel Weston – Property Developer, Sharrow