Milton Keynes Property Finance Solutions

Hassle-free, fast property bridging loan in Milton Keynes.

Lending Experts for Milton Keynes

Milton Keynes property market is experiencing one of the fastest changes and sales cycles of the entire region and it is a result of this town having very good commuter links, growing several business districts, and a continuous demand for modern family homes.

Your access to a bridging loan allows you to quickly take a step in the right direction and ensure the opportunity is yours without waiting for the decision from slow lenders. As our own funds are used for lending, we are very much focused on the delivery being of a fast, transparent, and confident nature from the very first call.

What we offer

- We offer loans ranging from £10,000 to £500,000

- Immediate decisions, often within 4 hours

- Funds deposited within 48 hours

- Simple application process

- Loans against residential property

- Loans for commercial property

- Short-term business finance

- Capital for purchasing property at auction

Apply for bridging in Milton Keynes

The moment you decide to take out the finance, we do not waste time and start immediately putting the process in order. The positioning of the valuations, interaction with the solicitors, and lender checks are all under our control. Hence, you can save your time and energy for other works. We also promptly keep you updated so you get to know how far along the application is, and what steps need to be taken next.

There is huge potential in Milton Keynes be it for buyers or investors. Whatever your reasons – if you are buying before selling, a refurbishment project, or a time-sensitive auction purchase, we always ensure the funding part is the least of your worries and is in a comfortable, predictable manner. We work through the entire process with one objective in mind– to get rid of any delays and streamline the process so funds can be withdrawn in the quickest time.

Homeowners

Place your home as a security to unlock vital funds that can help to stop chain delays or to carry out refurbishments on your building when cash is tight.

Developers

Borrow money over carefully planned out stages to bring your project to life. Great for commercial developments where management is key.

Commercial Investors

Secure the money needs to invest in new business locations, or to relocate current operations. Great for building or expanding investment portfolios.

Business owners

Navigate the day to day challenges of business more efficiently with fast capital injections. Good for stock replenishing or covering expenses.

The most popular bridging loan in Milton Keynes is £290,000

To quickly assess your loan affordability and repayment ability, use the calculator below.

Bridging Loan Calculator

Bridging: Indicative Quote

Total Security Value: £400,000.00

Gross Loan: £103,008.00

Gross LTV: 25.75%

Interest Rate: 0.84%

Breakdown

Arrangement Fee (2%): £2,000.00

Broker Fee (1%): £1,000.00

Total Interest: £10,080.00

Net Loan: £100,000.00

Legal Fees: £750.00

Valuation Fees: £380.00

Common uses for bridging loans in Milton Keynes

- Buying rental properties that are close to Milton Keynes Central station

- Gaining homes in the suburbs that are in high demand such as Shenley, Broughton, Middleton

- Paying for refinishing or refurbishing before getting a new loan

- Bridging the gap between an old sale and a new purchase

- Purchasing commercial units in the growing business districts

- Finishing auction purchases with the tightest timelines

- The relocation or expansion of a business within the wider Milton Keynes area

- Turning older homes into quality, well-paying rental properties

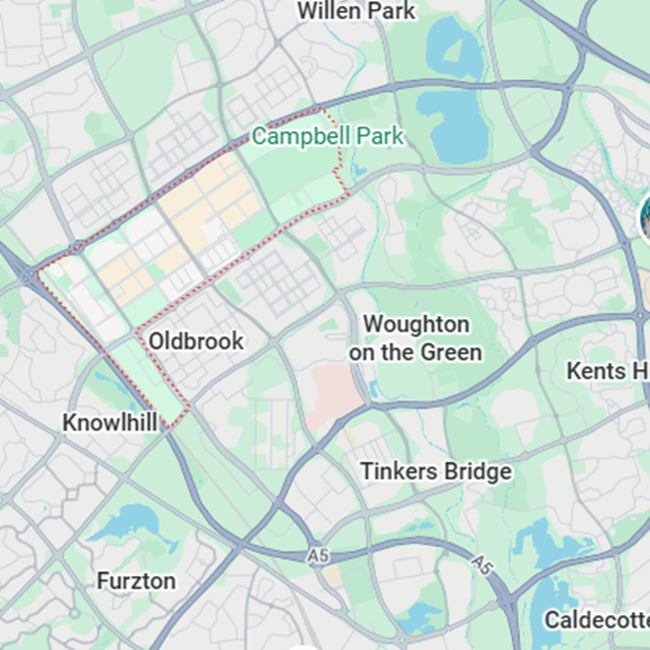

Areas we serve in Milton Keynes

- Shenley

- Broughton

- Willen

- Middleton

- Wolverton

- Stony Stratford

- Newport Pagnell

- Great Linford

- Caldecotte

- Woburn Sands

- Walnut Tree

- Emerson Valley

- Campbell Park

- Tattenhoe

- Bletchley

- Shenley Lodge

- Fishermead

- Kingston

- Oldbrook

- City Centre

“I managed to get £240,000 for a family home in Shenley before my sale was completed. Everything was done pretty quickly and I was surprised at how much faster than expected the whole process moved.”

Olivia Turner – Homebuyer, Shenley

“I brought in £108,000 to move my workshop to a unit near Wolverton. Goldhill Finance took care of everything professionally and I was kept updated throughout.”

Sam Richards – Business Owner, Wolverton

“I was in need of £360,000 for a refurbishment project in Broughton. The team did not waste any time in getting the work done and the funds were released to me at the exact time as per the contractor schedule.”

Michael Wade – Property Developer, Broughton