Bridging Loans in Derby

Hassle-free, fast property bridging loan in Derby.

Lending Experts for Derby

The local property market in Derby is just booming with rapid sales, it’s hard to stay abreast with the changes! Places such as Mickleover, Allestree, and Chellaston are always the most sought localities, and the trendiest houses get taken merely days after going on listing: proper family houses, student flats near the university, and commercial units around the expanding business parks.

With a bridging loan, you have the space and the pace to make a call on these offers immediately to prevent someone else from taking them. Since we run our direct lending funds, it’s most of the times possible to get a “yes” (and get it agreed) within only a few hours. This is the point when you are in full control of the situation.

What we offer

- We offer loans ranging from £10,000 to £500,000

- Immediate decisions, often within 4 hours

- Funds deposited within 48 hours

- Simple application process

- Loans against residential property

- Loans for commercial property

- Short-term business finance

- Loans for successful auction bids

Want to find a bridging loan in Derby?

Once you contact us, we don’t stop until the job is done. We handle the solicitor work, valuations, legal formalities, and lender communications so that everything runs smoothly. We have made the entire procedure as easy and rapid as feasible since we are aware that your time is precious.

Speed is still the most valuable thing in Derby. Whatever your situation is – a purchase before selling, a buy-to-let investment in a popular area, a need for cash to finish a refurb or something else – we are there with you to help you skip the waiting game and get your money quickly and efficiently. While other people are waiting for their bank to take a decision, you are already able to carry on with your plans.

Homeowners

Place your home as a security to unlock vital funds that can help to stop chain delays or to carry out refurbishments on your building when cash is tight.

Developers

Borrow money over carefully planned out stages to bring your project to life. Great for commercial developments where management is key.

Commercial Investors

Secure the money needs to invest in new business locations, or to relocate current operations. Great for building or expanding investment portfolios.

Business owners

Navigate the day to day challenges of business more efficiently with fast capital injections. Good for stock replenishing or covering expenses.

The most popular bridging loan in Derby is £300,000

Bridging Loan Calculator

Bridging: Indicative Quote

Total Security Value: £400,000.00

Gross Loan: £103,008.00

Gross LTV: 25.75%

Interest Rate: 0.84%

Breakdown

Arrangement Fee (2%): £2,000.00

Broker Fee (1%): £1,000.00

Total Interest: £10,080.00

Net Loan: £100,000.00

Legal Fees: £750.00

Valuation Fees: £380.00

Common reasons for bridging in Derby

- Purchasing rental properties close to the University of Derby

- Buying large family homes in areas like Mickleover or Allestree, which are highly sought after

- Converting old terraced houses into trendy HMOs

- Remodeling of the home before refinancing via a longer-term mortgage

- Snapping up commercial units around Pride Park and the other business hubs

- Helping businesses expand or relocate anywhere across Derby

- Refinancing / cash flow, business uses

- Exit from development finance / holding gap

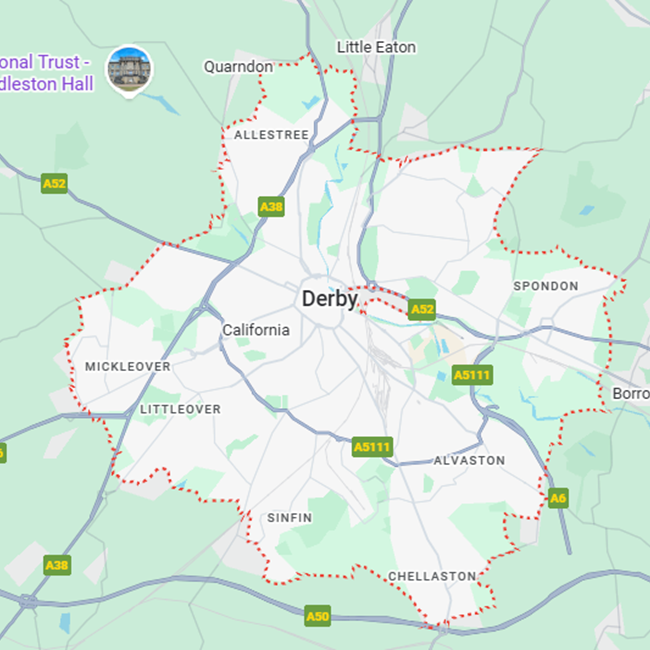

Local areas we serve in and around Derby

- Mickleover

- Allestree

- Chellaston

- Littleover

- Alvaston

- Pride Park

- Chaddesden

- Oakwood

- Normanton

- Spondon

- Darley Abbey

- Wilmorton

- Sinfin

- Borrowash

- Boulton Moor

- Derby City Centre

- Shelton Lock

- Mackworth

- Kedleston

- King's Quarndon

“In the time before the sale of my own property, I had to come up with £210,000 to complete the renovation of a family home in Mickleover. Goldhill Finance was the factor that kept the transaction flowing and they were very much quicker than I had anticipated.”

Rebecca Shaw – Homebuyer, Mickleover

“I took a loan of £95,000 to alleviate cash flow problems during my move of the garage workshop near Pride Park. Honestly, everything was very easy and smooth from the get-go to the very end and at every step, decisions were made quickly.”

Dean Foster – Business Owner, Pride Park

“I had to do a refurbishment project in Allestree and thus, I needed £360,000 to fill in the gap between different stages. The team not only fully comprehended the timeline but also they didn’t have any hold-ups when they issued the money.”

Gareth Linton – Property Developer, Allestree