Accessible Property Bridging Finance in Birmingham

Lending Experts for Birmingham

When it is about timing only, bridging loans in Birmingham are the means that bring to you the speed as well as the flexibility for you to be able to make your move fast. Our short-term finance solutions are aimed at closing transactional gaps quickly and without any hassle.

The Birmingham property and investment market is a very quick one and if it moves, then delays lead to opportunities forming in to losses. We do not waste any time in getting to know your situation so that we can offer the most suitable solution – usually within a few hours or a day, not weeks.

What we offer

- Loan sizes from £10,000 to £500,000

- Immediate decisions, often within 4 hours

- Funds deposited within 48 hours

- Simple application process

- Loans against residential property

- Loans for commercial property

- Short-term business finance

- Loans for buying property at auction

Bridging loan arrangements in Birmingham

Long, protracted procedures are something that you can forget. We manage all paperwork, communicate with solicitors and valuers, and handle all the correspondence from your first enquiry up to the drawdown, thus giving you the opportunity to concentrate on your next move instead of the logistics.

Our mission is to support you without any delay in the realisation of new ventures. If you happen to be a homeowner, investor or developer – we got you. Being a vastly knowledgeable company that knows the Birmingham area inside and out, we are able to offer you quick and flexible bridging finance – a perfect match for property movers in Birmingham.

Homeowners

Place your home as a security to unlock vital funds that can help to stop chain delays or to carry out refurbishments on your building when cash is tight.

Developers

Borrow money over carefully planned out stages to bring your project to life. Great for commercial developments where management is key.

Commercial Investors

Secure the money needs to invest in new business locations, or to relocate current operations. Great for building or expanding investment portfolios.

Business owners

Navigate the day to day challenges of business more efficiently with fast capital injections. Good for stock replenishing or covering expenses.

The most popular bridging loan in Birmingham is £225,000

Use the calculator below to assess your potential borrowing capacity and repayment ability.

Bridging Loan Calculator

Bridging: Indicative Quote

Total Security Value: £400,000.00

Gross Loan: £103,008.00

Gross LTV: 25.75%

Interest Rate: 0.84%

Breakdown

Arrangement Fee (2%): £2,000.00

Broker Fee (1%): £1,000.00

Total Interest: £10,080.00

Net Loan: £100,000.00

Legal Fees: £750.00

Valuation Fees: £380.00

Birmingham bridging finance uses

- Buy-to-let or investment acquisitions

- Land or commercial property purchase / change of use

- Downsizing or repositioning

- Breaking a property chain

- Auction purchases

- Refurbishment or conversion of a property

- Managing business or cash-flow gaps

- Exit from development or interim finance

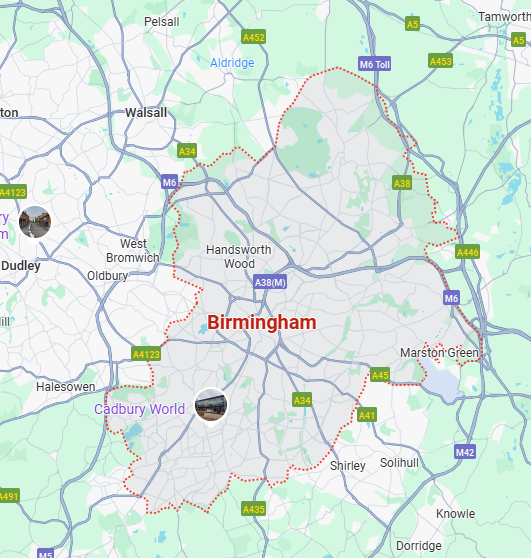

Birmingham areas we serve

- Jewellery Quarter

- Selly Oak

- Kings Heath

- Erdington

- Aston

- Digbeth

- Edgbaston

- Shirley

- Bournbrook

- Perry Barr

- Moseley

- Hockley

- Sutton Coldfield

- Erdington

- Handsworth

- Harborne

- Bournville

- Solihull

- Castle Vale

- Ladywood

“Needed £220,000 as a short-term bridging loan to secure an inner-city purchase in Birmingham; the team managed everything seamlessly and completed on time without hassle.”

Emma Carter – Property Investor, Digbeth

“We used Goldhill Finance for a bridging loan of £140,000 to finalise a commercial conversion in Harborne – funds were in place rapidly, and the process had full clarity from start to finish.”

David Evans – Developer, Harborne

“Goldhill Finance made it easy to access a bridging facility. Excellent communication, quick turnaround and no unnecessary complications in arranging the £310,000 we needed.”

Sarah Khan – Landlord, Moseley