Bridging Loans in Brighton

Private lender funding is fast to arrange in Brighton, which ultimately lead to quick deal completions.

Lending Experts for Brighton

The housing market in Brighton is really fast and hard to beat, which is why a lot of people want to buy properties along the seafront, in the laneways and the student areas, as well as in the commuter zones that have a direct link to London. In Kemptown, a house for sale, a flat for rent, or a few rooms in Lewes Road will be snapped up in no time by the people who have already showed their interest but now have to compete for them with other bidders.

A bridging loan will give you that extra push and will definitely be your strongest weapon in the property battle.

What we offer

- The loan sizes are between £10,000 and £500,000

- The selection process calls for decisions that are made without delay and within 4 hours

- Money will be available for withdrawal two days after

- The application requires only minimal formalities

- Secured loans on residential property

- Secured loans on commercial property

- Short-term business loan

- Loans to fund auction property acquisitions

Apply for a bridging loan in Brighton

If you get in touch with us, we take the initiative to work on the coordination part of the steps that usually act as hurdles for transactions. We can get valuations done quickly, open lines of communication with solicitors and keep the schedule on track, thus letting you out of the responsibility of the process. You will be provided all the time with the knowledge on the current phase of your application and the subsequent step to be taken.

Brighton is a place that pays a return on investment made with trust and courage. No matter if you are purchasing first and then selling, undertaking a refurbishment project or finalizing a time-sensitive auction purchase, the efficiency and predictability in the funding side will be what we deliver. We intend to make the funds accessible at the earliest possible moment through which you can then grasp new opportunities while they are still available.

Homeowners

Place your home as a security to unlock vital funds that can help to stop chain delays or to carry out refurbishments on your building when cash is tight.

Developers

Borrow money over carefully planned out stages to bring your project to life. Great for commercial developments where management is key.

Commercial Investors

Secure the money needs to invest in new business locations, or to relocate current operations. Great for building or expanding investment portfolios.

Business owners

Navigate the day to day challenges of business more efficiently with fast capital injections. Good for stock replenishing or covering expenses.

The most popular loan in Brighton is £195,000

Bridging Loan Calculator

Bridging: Indicative Quote

Total Security Value: £400,000.00

Gross Loan: £103,008.00

Gross LTV: 25.75%

Interest Rate: 0.84%

Breakdown

Arrangement Fee (2%): £2,000.00

Broker Fee (1%): £1,000.00

Total Interest: £10,080.00

Net Loan: £100,000.00

Legal Fees: £750.00

Valuation Fees: £380.00

Bridging loans are most commonly used for

- Purchasing student rentals in areas like Lewes Road and the university.

- Finding apartments and homes in Kemptown or along the seafront.

- Modernising beforehand and then refinancing.

- Obtaining temporary finance while awaiting the completion of a sale.

- The purchase of commercial units in the areas of Brighton and Hove.

- The completion of auction purchases where short completion times apply.

- Helping with business relocation or growth within the city.

- Changing old properties to letting them out for high yielding rental accommodation.

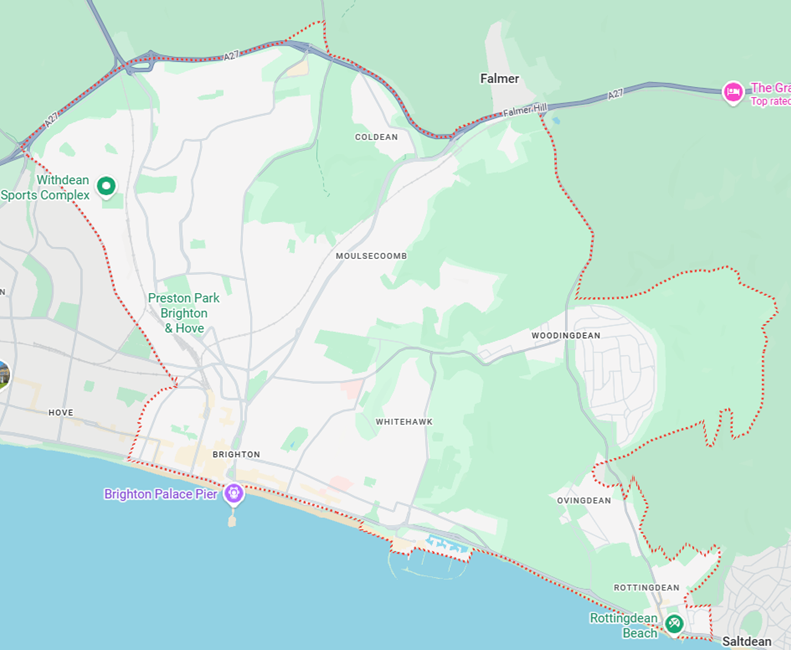

Local areas we serve in Brighton

- Kemptown

- Hove

- Hanover

- Fiveways

- Preston Park

- Seven Dials

- Brighton Marina

- London Road

- Whitehawk

- Queen’s Park

- Elm Grove

- Hollingdean

- Withdean

- Saltdean

- Moulsecoomb

- Patcham

- Portslade

- Shoreham

- Rottingdean

- Brighton City Centre

“The team was perfectly aligned and in control of the situation right from when I needed £240,000 to secure a flat in Kemptown till the moment my sale had progressed. Thanks to them, everything moved smoothly.”

Emily Fraser – Homebuyer, Kemptown

“I moved my studio from Hove to a larger unit with the help of £110,000 that I raised. Goldhill Finance was great at handling the communication and making the process super easy for me.”

Leo Brooks – Business Owner, Hove

“I needed £355,000 for a refurbishment project near Preston Park. The whole application was done very quickly and on my money release date the funds were already handed over.”

Isobel Clarke – Property Developer, Preston Park