Fast Decision Bridge Loans in Cheshire

Lending Experts for Cheshire

The high-value residential market, the rivalry for commuter hotspots, as well as the demand for semi-rural sites, stimulate the Cheshire real estate market. Whether it is high-end housing in Wilmslow or Alderley Edge, opportunities in the vicinity of Crewe, or Northwich, sales can progress quicker than the finance can. A bridging loan enables a buyer to take timely action.

We ensure the prevention of delays, which are not so uncommon to hinder time-sensitive Cheshire transactions because of effective decision-making and with the help of experienced lending partners.

What we offer

- Loan amounts starting at £10,000 to £500,000

- Decisions on most applications take as little as 4 hours

- Money can be put in your bank in as fast as 48 hours

- Straightforward application, no hassles

- Lending on residential property

- Property loans for commercial buildings

- Short-term business finance

- Property loans for auction purchases

Apply for a bridging loan in Cheshire

We will ensure that the process is easy from the start. After knowing what you are going through, we will ensure that everything is synchronised in relation to the valuation, the legal aspects, as well as the requirements by the lender.

Bridging finance is often used in Cheshire to secure properties in prime areas or to lubricate the wheels of transactions when chains or refinancing schedules are not matched. We concentrate on clearing uncertainty by determining viability as soon as possible and making sure that there are no problems in communications.

In the instance of short-term funding in prop property or capital tied to an investment property, we aim to ensure that any funding release takes place efficiently and in line with the exit strategy.

Homeowners

Place your home as a security to unlock vital funds that can help to stop chain delays or to carry out refurbishments on your building when cash is tight.

Developers

Borrow money over carefully planned out stages to bring your project to life. Great for commercial developments where management is key.

Commercial Investors

Secure the money needs to invest in new business locations, or to relocate current operations. Great for building or expanding investment portfolios.

Business owners

Navigate the day to day challenges of business more efficiently with fast capital injections. Good for stock replenishing or covering expenses.

£265,000 is the most common bridging loan in Cheshire

Use our calculator below to get an approximate idea of how much you could borrow and what your repayments might look like.

Bridging Loan Calculator

Bridging: Indicative Quote

Total Security Value: £400,000.00

Gross Loan: £103,008.00

Gross LTV: 25.75%

Interest Rate: 0.84%

Breakdown

Arrangement Fee (2%): £2,000.00

Broker Fee (1%): £1,000.00

Total Interest: £10,080.00

Net Loan: £100,000.00

Legal Fees: £750.00

Valuation Fees: £380.00

Common bridge loan use cases in Cheshire

- Purchase of high-value residential property before the completion of any existing sale.

- Financing the refurbishment of improved houses before sale/ refinancing

- Bridging delays caused by property chains/legal hold-ups

- Buying land or property while waiting for planning consent

- Buying an office building before taking up long-term financing

- Completing auction purchases with tight deadlines

- Releasing equity to put in short-term business opportunities

- Buying property in competitive commuter spots

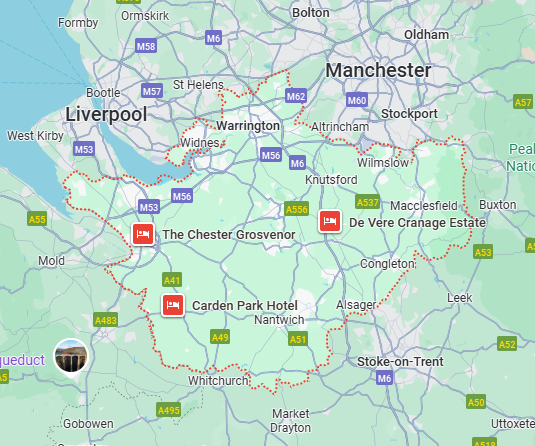

Local areas we serve in and around Cheshire

- Wilmslow

- Alderley Edge

- Knutsford

- Macclesfield

- Chester

- Crewe

- Northwich

- Winsford

- Congleton

- Sandbach

- Middlewich

- Nantwich

- Frodsham

- Runcorn

- Widnes

- Lymm

- Disley

- Poynton

- Tarporley

- Hale

“I required a cash loan facility for £320,000 to complete a residential purchase in Wilmslow until such a time as my existing property could be sold. Goldhill Finance moved very efficiently, keeping everything on track for me.”

Andrew Collins – Homeowner, Frodsham

“Arranged a bridging loan of £140,000 to finance refurbishment works on a property near Knutsford prior to refinance. We were very efficient, communicated clearly from the start, and made decisions quickly without having to go back and forth unnecessarily.”

Laura Bennett – Portfolio landlord, Knutsford

“Aranged funding of £460,000 to fill a gap between development stages on a site outside Crewe. This was very efficient and communication was very good.”

Mark Ellison – Property Developer, Crewe