Acquiring Property in Hertford Quickly

Access private lender solutions for quick finance deals with hassle-free process.

Lending Experts for Hertford

Hertford is a town with a property market that changes rapidly and is fuelled by the good rail links to the city for the daily commuters, the attractive residential areas and the continuous demand for rental properties located next to the local amenities.

When things move at such pace, a bridging loan is what you actually need to be able to react rapidly and grab the right property without being troubled with the regulations of the traditional lenders. When choices are done employing our own lending lines, we put emphasis on the following: uninterrupted communication, straightforward help, and prompt results.

What you get from us

- Loan options of £10,000 and as high as £500,000

- Immediate decisions, hear back from us in 4 hours

- Money wired to your bank as quickly as 48 hours

- Easy application and simple communication

- Loans against residential property

- Loans for commercial or investment purchases

- Short-term business finance arrangements

- Loans tailored for auction property transactions

Apply for a bridging loan in Hertford

The moment you make a decision, we start the process of putting together all the necessary steps for taking your application to the next level. We do the valuations, cooperate with the solicitors and execute the lender requirements in such a way that you do not need to be doing everything separately. You get regular updates and we keep you informed of the process at each stage.

Hertford is a good place for those home buyers and property investors who are capable of making a quick decision. Are you planning to buy before selling, a purchase at an auction, or a refurbishment project? We function to keep the financing process at an optimum level. The major work of our team is to ensure that there is no hold-up and at the same time they release the money fast so that the property can be yours without the risk of losing out.

Homeowners

Place your home as a security to unlock vital funds that can help to stop chain delays or to carry out refurbishments on your building when cash is tight.

Developers

Borrow money over carefully planned out stages to bring your project to life. Great for commercial developments where management is key.

Commercial Investors

Secure the money needs to invest in new business locations, or to relocate current operations. Great for building or expanding investment portfolios.

Business owners

Navigate the day to day challenges of business more efficiently with fast capital injections. Good for stock replenishing or covering expenses.

The most popular bridging loan in Hertford is £95,000

Use the calculator below to assess your borrowing capacity and repayment costs.

Bridging Loan Calculator

Bridging: Indicative Quote

Total Security Value: £400,000.00

Gross Loan: £103,008.00

Gross LTV: 25.75%

Interest Rate: 0.84%

Breakdown

Arrangement Fee (2%): £2,000.00

Broker Fee (1%): £1,000.00

Total Interest: £10,080.00

Net Loan: £100,000.00

Legal Fees: £750.00

Valuation Fees: £380.00

Typical bridging loan uses in Hertford

- Purchasing rental properties within the vicinity of Hertford East or Hertford North stations

- Buying family homes in Bengeo, Sele Farm or Hertford Heath areas

- Renovating period properties prior to getting a new mortgage

- Using bridging finance if there is a delay in your current sale

- Purchasing commercial premises in the area of Hertford and the neighbouring villages

- Finishing auction purchases where the completion date is shortly after the auction

- Helping with business relocation or growth

- Turning older properties into stylish rental accommodation

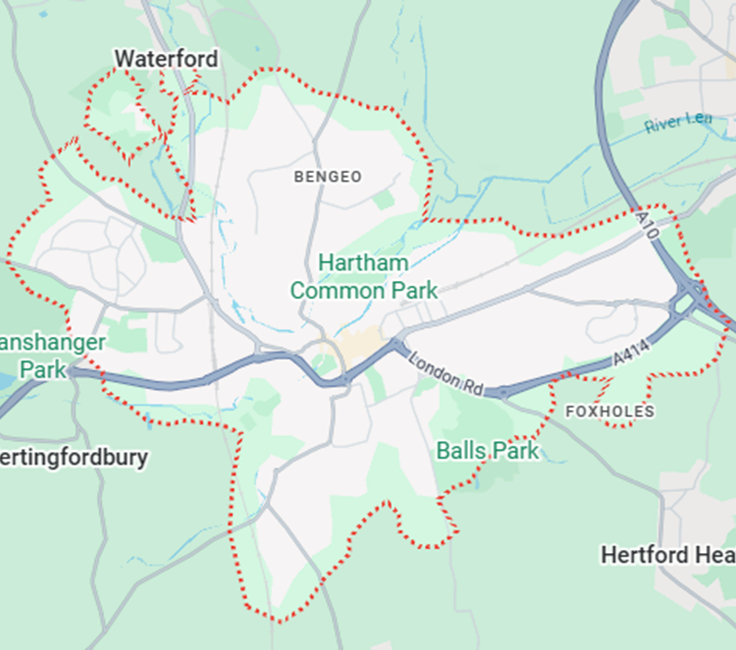

Hertford areas we serve

- Bengeo

- Hertford Heath

- Sele Farm

- Waterford

- Brickendon

- Hertingfordbury

- Chapmore End

- Great Amwell

- Little Amwell

- Broxbourne

- Stanstead Abbotts

- Hoddesdon

- Bayford

- Ware

- Tonwell

- Rush Green

- Pinehurst

- Munden

- Hertford Town Centre

- Amwell End

“For a refurbishment project near Bengeo, I needed £312,000. Goldhill Finance was very efficient in handling the entire process and made the fund available at the exact time when my contractors needed it.”

Tom Randall – Property Developer, Bengeo

“I managed to raise £101,500 to take care of my short-term costs while I was relocating my workshop near Hertford Heath. The communication was very good throughout and the application proceeded without any delays.”

Fiona Marsh – Business Owner, Hertford Heath

“I was able to get £248,000 to complete a rental property close to Hertford East station. The team were very helpful in keeping everything on track and the funding came earlier than expected.”

David Slater – Investor, Hertford East