Need fast bridging in Newcastle?

Lending Experts for Newcastle

Goldhill Finance Ltd is a lender with difference – one that values speed and flexibility above any other metrics. When you are short of time and see an opportunity in Newcastle, our bridging loans are the exact route needed to amplify your cash reserves. There are no long waiting periods and you do not have to go through any complicated back-and-forth. It is just simple, short-term finance that helps you achieve the result.

Property markets in Newcastle are changing all the time. Therefore, we pivot too. Actually, we listen to your needs only and then we communicate with our product team. We are usually able to give you our decision within a few hours – sometimes even less. So, you are not left in suspense when it is really a matter of time.

Come and benefit from:

- Loans from £10,000 to £500,000

- Decisions in as little as 4 hours

- Money in your account within 48 hours

- A quick, hassle-free application

- Funding for both residential and commercial property

- Short-term business finance

- Help through every step

- Auction real estate loans

Complete a bridging application in Newcastle

Applying with us for a bridging loan in Newcastle is straightforward. We will help you through the entire process, take care of the paperwork, and keep you informed all the time.

It does not matter whether you are a homeowner, an investor, or a developer. If you are in need of fast, reliable finance in Newcastle, we are the ones to help you make your next move free of the usual delays.

Homeowners

Place your home as a security to unlock vital funds that can help to stop chain delays or to carry out refurbishments on your building when cash is tight.

Developers

Borrow money over carefully planned out stages to bring your project to life. Great for commercial developments where management is key.

Commercial Investors

Secure the money needs to invest in new business locations, or to relocate current operations. Great for building or expanding investment portfolios.

Business owners

Navigate the day to day challenges of business more efficiently with fast capital injections. Good for stock replenishing or covering expenses.

The most popular bridging loan in Newcastle is £80,000

Use the calculator below to assess your potential borrowing capacity and repayment ability.

Bridging Loan Calculator

Bridging: Indicative Quote

Total Security Value: £400,000.00

Gross Loan: £103,008.00

Gross LTV: 25.75%

Interest Rate: 0.84%

Breakdown

Arrangement Fee (2%): £2,000.00

Broker Fee (1%): £1,000.00

Total Interest: £10,080.00

Net Loan: £100,000.00

Legal Fees: £750.00

Valuation Fees: £380.00

Newcastle bridging finance scenarios

- Financing home extensions or major refurbishments

- Bridging short-term cash flow for property developers

- Purchasing investment properties at auction

- Covering planning application or permit costs

- Unlocking equity to invest in new projects

- Financing split property transactions or chains

- Renovation of heritage or listed buildings

- Funds for commercial property refurbishments

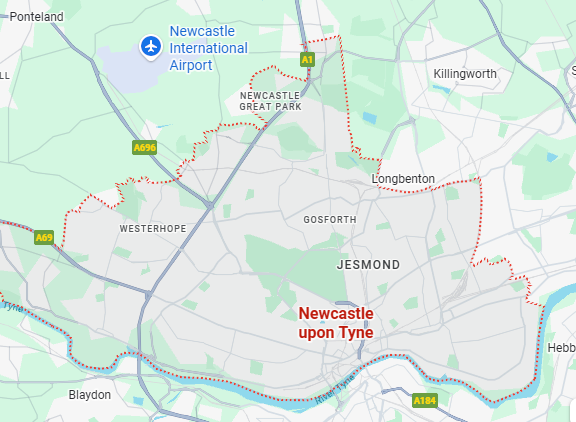

Newcastle areas we serve

- Newcastle City Centre

- Jesmond

- Heaton

- Gosforth

- Fenham

- West End

- Kingston Park

- Byker

- Sandyford

- Ouseburn

- Benwell

- Kenton

- Walker

- Newcastle Quayside

- Low Fell

- Gateshead

- Whitley Bay

- Wallsend

- Blakelaw

- Forest Hall

“I needed £40,000 to finalise a property purchase in Jesmond. Goldhill Finance handled the process quickly and efficiently, and the funds were released within two days.”

Helen Wright – Investor, Jesmond

“We arranged a £115,000 loan through Goldhill to complete a refurbishment in Heaton. Communication was clear, and everything was completed on time.”

Liam Douglas – Developer, Heaton

“Goldhill Finance helped us raise £80,000 for a business opportunity in Gosforth. The service was fast, professional and completely stress free.”

Rachel Moore – Landlord, Gosforth