Secure Property Loans in Surrey

Short-term funding across Surrey backed on residential or commercial properties.

Lending Experts for Surrey

Surrey’s property market is electric. Strong demand and excellent transportation links mean that consistently high property values push up sale prices; homes don’t stay on the market for very long. Whether it is a family house in Guildford or Woking, or a property of luxury in Weybridge or Esher, sales can often move more quickly than traditional loans can keep up with. That is where bridging finance comes in, securing buyers the property they want when timing matters more than price.

In our years of service, no matter the type of property and location within Surrey, we have facilitated loan services for residential as well as commercial properties. In fact, our clients have even used our loan services for dual-purpose land. Indeed, our role is simple: to assist our clients in capitalising on opportunities and ensuring that loan servicing is aligned with long-term strategies.

What we offer

- Loan amounts starting at £10,000 to £500,000

- Decisions on most applications take as little as 4 hours

- Money can be put in your bank in as fast as 48 hours

- Straightforward application, no hassles

- Lending on residential property

- Property loans for commercial buildings

- Short-term business finance

- Auction purchase financing solutions

How our Surrey bridging facilities work

Right from the very first conversation, we assume control. “We will handle the valuations, communicate with the attorneys, and work with the lenders. This way, you are not being asked to keep a lot of loose variables under control,” says David.

Usually, it can be proved that, for most people, the initial reason they would consider the use of a bridging loan in respect of Surrey would be speed. For example, with regard to an urgent sale being available, we therefore operate to ensure that your funds are released within the time scale for completion.

Homeowners

Place your home as a security to unlock vital funds that can help to stop chain delays or to carry out refurbishments on your building when cash is tight.

Developers

Borrow money over carefully planned out stages to bring your project to life. Great for commercial developments where management is key.

Commercial Investors

Secure the money needs to invest in new business locations, or to relocate current operations. Great for building or expanding investment portfolios.

Business owners

Navigate the day to day challenges of business more efficiently with fast capital injections. Good for stock replenishing or covering expenses.

£165,000 is the most common bridging loan in Surrey

Use our calculator below to get an approximate idea of how much you could borrow and what your repayments might look like.

Bridging Loan Calculator

Bridging: Indicative Quote

Total Security Value: £400,000.00

Gross Loan: £103,008.00

Gross LTV: 25.75%

Interest Rate: 0.84%

Breakdown

Arrangement Fee (2%): £2,000.00

Broker Fee (1%): £1,000.00

Total Interest: £10,080.00

Net Loan: £100,000.00

Legal Fees: £750.00

Valuation Fees: £380.00

Example bridging uses in Surrey

- Buying of a new property and not waiting on selling the existing one

- Financing renovation works to be done before refinancing

- Obtaining possession of the property before final mortgage approval is passed

- Collaborating and synching with developers from early get-go phase

- Securing the funding to buy commercial and mixed-use properties

- Tapping into your real-estate equity for short-term investments

- Completing a purchase quickly when timing is critical

- Converting period properties into high yielding rental accommodation

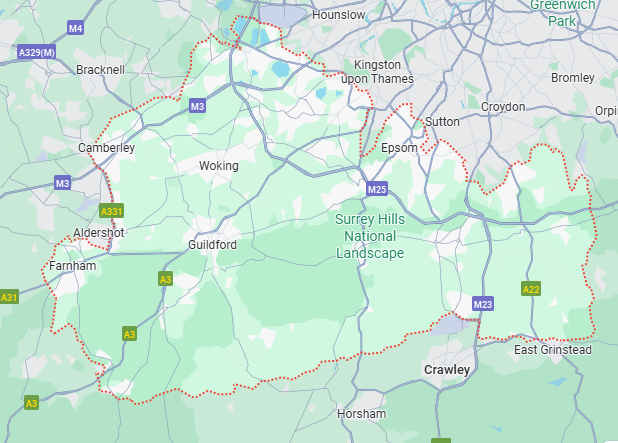

Local areas we serve in and around Surrey

- Guildford

- Woking

- Epsom

- Reigate

- Redhill

- Farnham

- Camberley

- Leatherhead

- Dorking

- Esher

- Weybridge

- Cobham

- Godalming

- Haslemere

- Horley

- Ashford

- Staines-upon-Thames

- Sunbury-on-Thames

- Virginia Water

- Chertsey

“We had to raise a sum of £385,000 to buy a new property in Weybridge within a specified time limit to secure a purchase of a new property, as our own house was being sold. This process took place in a very efficient manner, which had very positive results.”

Daniel Harper – Domestic Buyer, Weybridge

“Organised funds of £160,000 for the delay period for a refinancing facility for an investment property at Guildford. The period leading up to making contact with Goldhill had proven to be very stressful for us. Everything went to plan, and the resolutions were rapid.”

Rachel Owens – Portfolio Landlord, Guildford

“Utilised a bridging facility of £420,000 in acquiring a mixed development property in and around Woking. The completion was within a short timeframe. The funds were disbursed up to completion time and the process was handled accordingly.”

Rashid Akbar – Investor, Woking